News

D&L Industries’ reports 1Q21 results

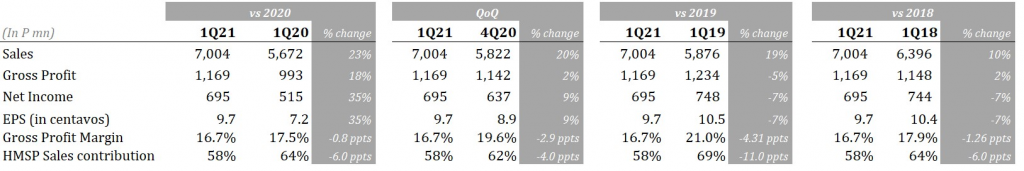

- Recovery continued in 1Q21 with net income at P695mn, +35% YoY, +9% QoQ

- All segments posted significant recovery YoY

- 1Q21 income tracking ahead of FY19 income but slightly behind FY18 income

- Export sales +84% YoY in 1Q21; Contribution to total sales reached a record high of 34%

- Mr. Franco Diego Lao was appointed as the new Chief Financial Officer

May 5, 2021 – D&L Industries’ recovery continued in the first quarter of 2021 (1Q21), with earnings growing 35% year-on-year (YoY) and 9% quarter-on-quarter (QoQ) to P695 million. All segments posted significant recovery YoY with consolidated income tracking ahead of FY19 income, albeit still slightly behind FY18 income. Earnings before interest and taxes was higher by 22% YoY to P879 million.

Management Perspective

“It’s been a year into the pandemic and we find ourselves back into another round of Enhanced Community Quarantine (ECQ) for two weeks and Modified Enhanced Community Quarantine (MECQ) after. While the business environment continues to be less than ideal, we also find ourselves, as well as many of our customers, in a much better position operationally to navigate the current situation with minimal business disruption,” remarked President & CEO Alvin Lao.

“Unlike the ECQ/MECQ in 2020, this year’s ECQ/MECQ is much less restrictive, as can be seen from the 35% YoY growth in 1Q21 earnings. With the government’s stance to protect public health and with the gradual rolling out of vaccines, we believe that the same trend would likely be observed in the succeeding quarters.

“Notwithstanding an apparent hiccup in the road to recovery, we believe that medium- to longterm business prospects are still intact. Our products generally serve basic industries. From our past experience, after every crisis, when recovery starts, we usually start seeing good growth in the businesses we are in,” Lao concluded.

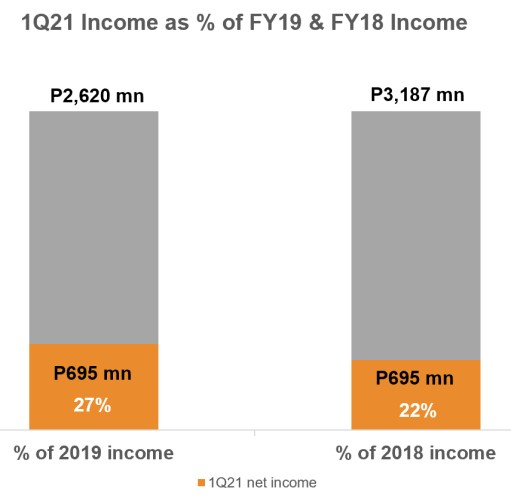

All segments posted significant recovery YoY with 1Q21 income tracking ahead of FY19 income but slightly behind FY18 income

In 1Q21, all of the company’s business segments posted significant recovery YoY. The recovery was mainly driven by people and businesses gradually adapting to the new normal. With more than a year into the pandemic, D&L, as well as many of its customers, has found new ways to continuously operate despite various mobility restrictions. This is true, not just for the chemicals segment but also for the food ingredients space wherein many food companies are now betterequipped to service customers on a 100% takeout or delivery basis.

In addition, lower income taxes due to the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act also boosted the company’s bottomline for the quarter by P32 million. The effective tax rate in 1Q21 stood at 18% vs 24% in 1Q20.

Compared to pre-pandemic levels, 1Q21 income seems to be tracking ahead of FY19 income but still slightly behind FY18 income. While the country reverted back to an Enhanced Community Quarantine (ECQ) for two weeks and remains to be in a Modified Enhanced Community Quarantine (MECQ), the business impact of the said quarantine status would seem not as damaging as last year given that these quarantine classifications are less restrictive this time around. For instance, public transportation is currently allowed on a limited basis, whereas last year, it was completely prohibited. In addition, the ECQ/MECQ is also currently being implemented in Metro Manila and selected areas only, whereas the entire island of Luzon was placed on ECQ/MECQ last year. Assuming that 1Q21 income holds steady in the next couple of quarters, the company is set to at least reach its net income level in 2019.

Export business continues to post resilient growth

Export sales continued its positive momentum in 1Q21 as it jumped 84% y-o-y. Export contribution to total revenues in 1Q21 reached a record high of 34%.

Coconut-based products under food and oleochemicals were the main drivers behind the robust export growth. Coconut oil continues to gain traction in the global market due to its perceived natural antiviral, antibacterial, and antifungal properties. In addition, coconut-based products are great sustainable substitutes for petroleum-based raw materials used in many applications such as personal hygiene and home cleaning products. The company sees continued strong coconut oil-based exports, which should offset some of the weakness in the domestic market in the near term.

Batangas expansion comes at an opportune time

D&L remains committed to its Batangas expansion and construction is in full swing. The company has so far spent about P4.5 billion for the project. Remaining capex to be spent this year and in the early months of 2022 stands at about P3.5 billion. The company made an announcement earlier this year that it plans to do a maiden bond offering to fund the remaining capex for this expansion.

The said facility will mainly cater to D&L’s growing export businesses in the food and oleochemicals segments. It will add the capability to manufacture downstream packaging, thus allowing the company to capture a bigger part of the production chain. For instance, while the company primarily sells raw materials to customers in bulk, the new plants will allow it to “pack at source”. This means that D&L will have the ability to process the raw materials and package them closer to finished consumer-facing products. This will enable D&L to move a step closer to its customers by providing customized solutions and simplifying their supply chain, which is of high importance given logistical challenges in general.

D&L’s Batangas expansion will be instrumental to its future growth as it plans to develop more high value-added coconut-based products and penetrate new international markets. The company to-date has successfully made in-roads in supplying various raw materials and even finished products in several relevant fast-moving consumer goods (FMCG) categories in the new normal. It plans to further expand its global footprint and targets export sales to account for at least 50% of its total sales in the long-term.

Rising commodity prices not a huge concern

Prices of some of the company’s key raw materials such as coconut and palm oil have rallied significantly in the past couple of months. Average coconut oil prices were up 72% YoY in 1Q21, already approaching its 4-yr high. Meanwhile, average palm oil prices were up 64% YoY in 1Q21, nearing its all-time high. As the company passes on price changes to customers, commodity price changes should have no significant impact on the company’s margins. However, as it takes the company 30-45 days to adjust its prices, a temporary margin contraction in an environment of rapid price changes is possible. Nonetheless, margins should eventually recover as the company adjusts its prices.

Operational and financial resilience

While the crisis posted various challenges, it has provided an equal opportunity to build further resilience. With appropriate adjustments and operational contingencies already in place, the company believes that it is now in a far better position to thrive in an adverse environment and a potentially protracted economic recovery period. Moreover, as the majority of the products that the company manufactures cater to basic essential industries such as food, oleochemicals, plastics and cleaning chemicals, the company sees continued strong demand ahead.

From a capital structure perspective, the company is in a solid position to withstand external pressure. As of end-March 2021, it remained lightly-geared with net debt at 22% and interest cover at 30x. In addition, the cash conversion cycle for the period was lower at 123 days vs 127 days in 2019, given lower account receivables and payable days.

Overall, the company remains profitable. Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 15.1% and 15.4%, respectively, in1Q21.

CFO Appointment

At the board meeting last May 4, 2021, Mr. Franco Diego Lao was appointed as D&L Industries’ new Chief Financial Officer. Mr. Lao will replace Mr. Amorsolo Rosario, who has retired after more than a decade with the company. The Company wishes to express its deepest thanks to Mr Rosario for his loyal and dedicated service.

Mr. Lao has 21 years of experience with the company. He started his career with D&L as a Product Representative for Oleo-Fats, Incorporated, moving up to Product Manager then to Supply Chain Manager for the business segment. In 2017, Mr. Lao was appointed as the Group Supply Chain Director for D&L Industries.

Mr. Lao holds a Bachelor of Commerce major in Accounting and Marketing degree from the University of Western Australia. With his extensive experience and familiarity with the group, the board is confident that Mr. Lao will be able to add more value to the company in his new capacity as the company continues to take on growth opportunities locally and internationally.

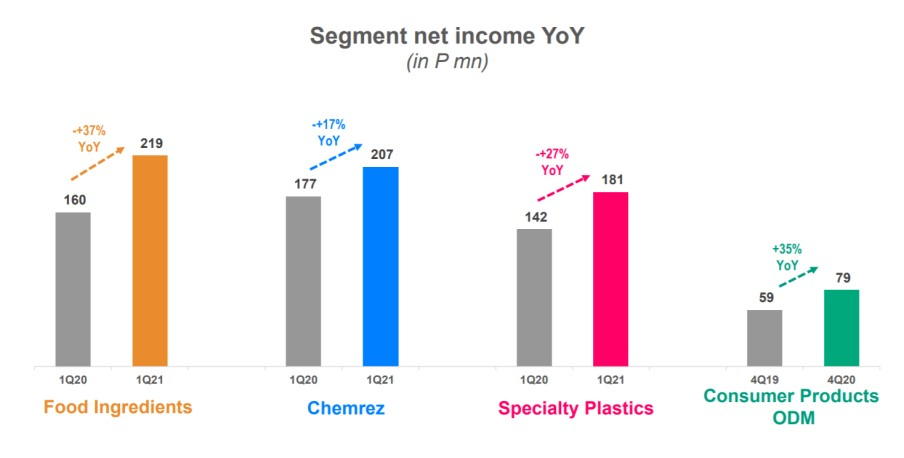

Segment Results

Food Ingredients

The sequential recovery in the food ingredients segment improved in 1Q21. On a quarter-onquarter basis, total volume was higher by 9% while income was up 32%. On a year-on-year basis, total volume was higher by 2% while income was up 37%. With many food companies now better equipped to operate under current mobility restrictions, the company expects gradual recovery in this segment to continue in the succeeding quarters.

Chemrez

Chemrez managed to post a 17% YoY increase in net income in 1Q21. Volumes were up 8% YoY which more than offset the overall margin compression of 5%. The margin compression mainly came from the Oleochemicals segment (chemicals derived from coconut oil) with coconut oil prices approaching its 4-yr high. While the company passes on price changes to customers, it takes the company 30-45 day to adjust its prices. As such, in an environment of rapid price changes, temporary margin contraction is possible. Nonetheless, the company sees its margins recovering in the succeeding quarters.

Specialty Plastics

Specialty plastics income increased by 27% YoY in 1Q21. This was driven by higher volume for both engineered polymers and colorants and additives. Total segment volume increased by 11% YoY for the period. The company expects steady and consistent demand moving forward given the crucial role that plastics play during the current pandemic — from various medical applications to packaging for parcel delivery.

Consumer Products ODM

Consumer products ODM, previously referred to as Aerosols, continued to post record earnings as demand for sanitation chemicals such as disinfectant sprays and alcohol saw a notable surge due to the pandemic. Revenues grew by 18% YoY and net income jumped by 35% YoY in 1Q21.

-end-–

D&L Industries is a Filipino company engaged in product customization and specialization for the food, chemicals, plastics and consumer products ODM industries. The company’s principal business activities include manufacturing of customized food ingredients, specialty raw materials for plastics, and oleochemicals for personal and home care use. Established in 1963, D&L has the largest market share in each of the industries it serves, as well as long-standing customer relationships with the Philippines’ leading consumer and manufacturing companies. It was listed on the Philippine Stock Exchange in December 2012. For more information, please visit https://dev.dnl.com.ph/investors/.

This press release may contain some “forward-looking statements” which are subject to a number of risks and uncertainties that could affect D&L’s business and results of operations. Although D&L believes that expectations reflected in any forward-looking statements are reasonable, D&L does not guarantee future performance, action or events.

INVESTOR RELATIONS CONTACT

Crissa Marie U. Bondad

Investor Relations Manager- D&L Industries, Inc.

+632 8635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph